What Is Ordinary Income On K1

Ordinary Business Income Loss The amount reported in box 1 is your share of the ordinary income loss from trade or business activities of the partnership. Ordinary income is any type of income earned by an organization or an individual that is taxable at ordinary rates.

Simple And Complete Guide To S Corporations Online Tax Professionals

How is K1 Income Taxed.

What is ordinary income on k1. To wrap up this topic was way back in the shadows for years but now is front and center for your self-employed borrowers who use K1 income from 1065 and K1 income from 1120S to qualify. Generally where you report this amount on Form 1040 or 1040-SR depends on whether the amount is from an activity that is a passive activity to you. In most cases this is income earned through work.

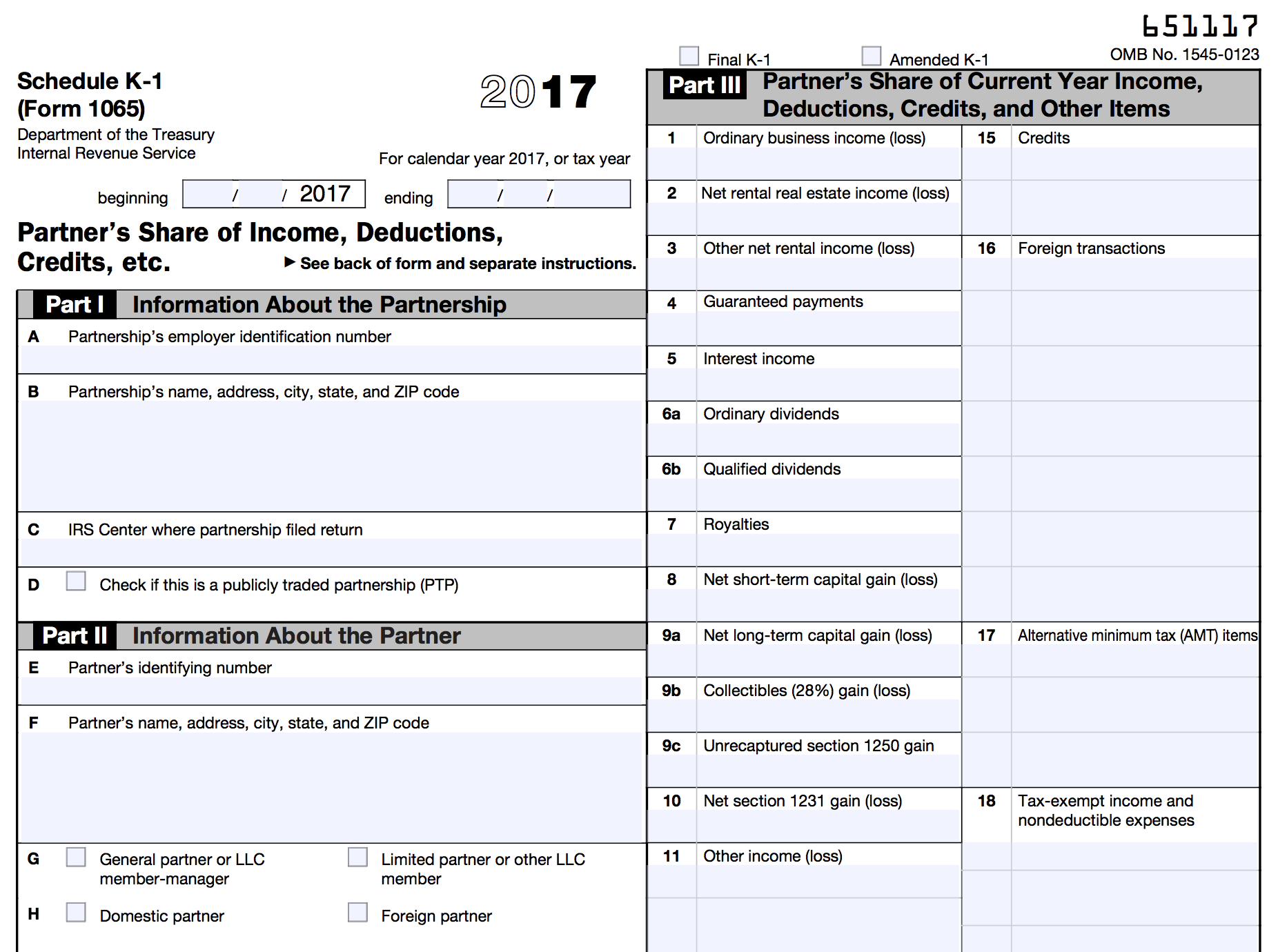

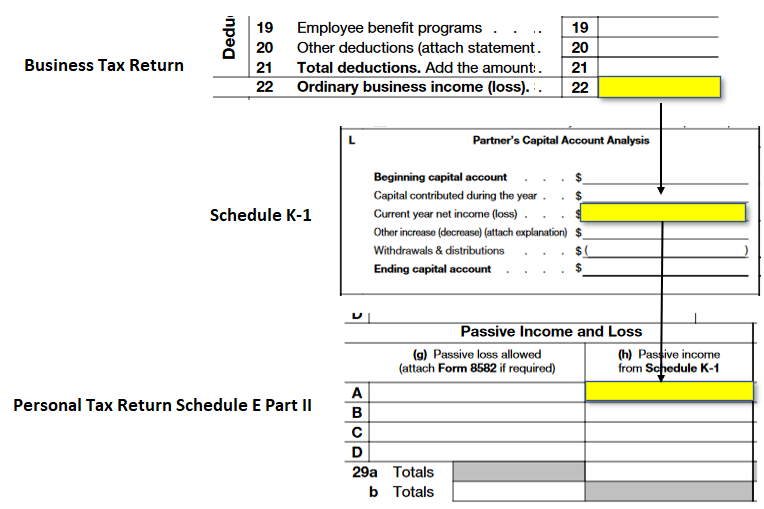

You have 10000 in the cost of goods sold COGS and 5000 in operating expenses. K-1 income or loss is passed through to the individual tax return. Line 1 - Ordinary IncomeLoss from Trade or Business Activities - Ordinary business income loss reported in Box 1 of the K-1 is entered as either Non-Passive IncomeLoss or as Passive IncomeLoss.

However Im not sure if I should give him the full 276970 due to the fact it is listed as Ordinary Business Income in Box 1 of the K-1. Thank you for the comment based on FNMA guidelines you first confirm the K-1 lines 123 and the CFAs and get a number. 39 Related Question Answers Found Are distributions from K 1 taxable.

Youll need that information on hand to fill out the form. In your example lines 123 _ CFA 3K so your income is supported by distribution no further review is required. Under Passthrough K-1s in the left navigation panel select Partnership Information.

Partnerships S Corporations estates and trusts provide K-1 forms to partners and shareholders for filing their individual tax returns. Profit from selling a product or providing a service is ordinary business income. It includes but is not limited to wages salaries tips bonuses rents.

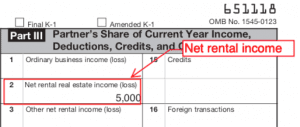

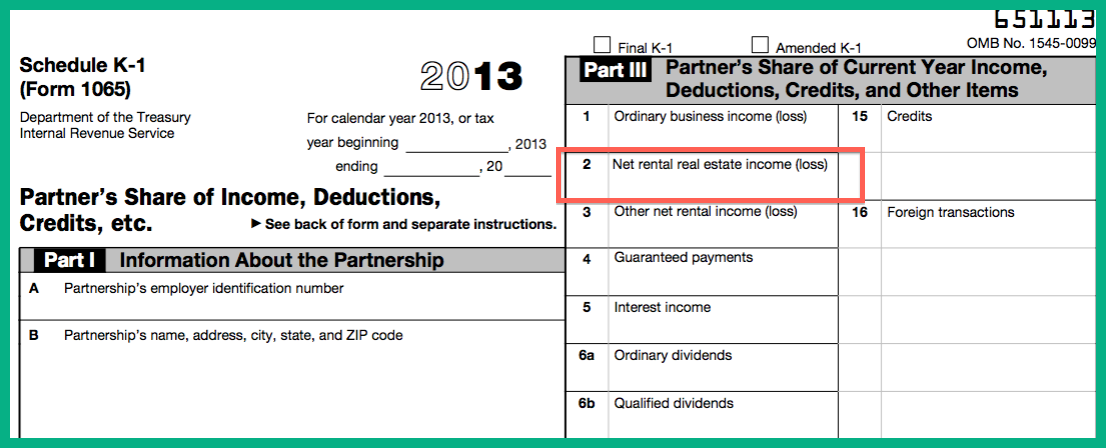

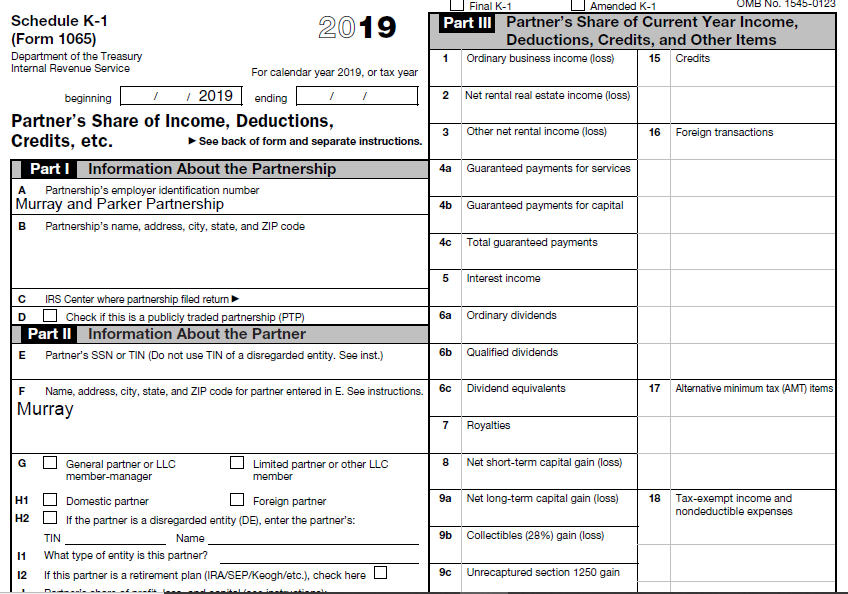

A partner can earn several types of income on Schedule K-1 including rental income from a partnerships real estate holdings and income from bond interest and stock dividends. Schedule K-1 is a tax document similar to a W-2 form. A typical corporations regular dividend is taxed as long-term capital gains while much of the income paid and shown on a Schedule K-1 can be classified as regular income.

However like any general rule there are a myriad of exceptions including one excepting a limited partners share of ordinary income from a. Beyond ordinary business income or losses Schedule K-1 also captures things like real estate income bond interest royalties and dividends capital gains foreign transactions and any other payments that you might have received as part of your involvement in the partnership. The K-1 indicates 276970 in ordinary business income and 176914 in Distributions.

Ordinary income is that years income that was derived by conducting the regular business of the partnership. The borrower confirmed he took the whole 276K. Income and tax liabilities are passed through the corporation or.

Ordinary business income includes any earnings your company makes through daily operations. For example you sell 20000 worth of products. Scroll down to the Part III - Lines 1-10- Partners Share of Current Year Income Loss section.

Im giving him the 176914 distribution as real income for sure. Another very simple example might occur if the S Corp originally purchased and now operates an antique store. Ordinary income is a type of income earned by an individual that is taxed at the marginal income tax rates set by the IRS.

Generally a taxpayers share of ordinary income reported on a Schedule K-1 from a partnership engaged in a trade or business is subject to the self-employment tax. Next you confirm the distributions support that income if they do not then you can change to a solvency test. Ordinary income can consist of income from wages salaries tips commissions bonuses and other types of compensation from employment interest dividends or net income from a sole proprietorship partnership or LLC.

Go to Screen 20 Passthrough K-1s. Enter the capital gain loss in 9a Net long-term capital. Generally where you report this amount on Form 1040 or 1040-SR depends on whether the amount is.

Ordinary income stems from the operation of the store. The amount reported in box 1 is your share of the ordinary income loss from trade or business activities of the corporation. Examples of ordinary income include wages salaries tips commissions and bonuses.

In addition to being the entry field for Ordinary Income Loss from Trade or Business Activities that is reported on Box 1 of the K-1 this field is used to make other entries that are reported to the taxpayer on a Schedule K-1 Form 1065 which should flow through to Schedule E Line 28 or to Worksheet 3. Follow these steps to enter a capital gain loss and ordinary gain loss from a passthrough partnership K-1.

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 1218 Pdf

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

A Guide To Investing In Master Limited Partnerships Mlps Intelligent Income By Simply Safe Dividends

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

What Is A Schedule K 1 Form Zipbooks

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

3 0 101 Schedule K 1 Processing Internal Revenue Service

What Is A Schedule K 1 Form Zipbooks

Linda Keith Cpa All About The 8825

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

Choose One Of The Partners Murray Or Parker And Chegg Com

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

Reporting Publicly Traded Partnership Sec 751 Ordinary Income And Other Challenges

Based Only On The Example Provided Fil Out The Form Chegg Com

Posting Komentar untuk "What Is Ordinary Income On K1"