Schedule K-1 Excess Business Interest Expense

Section 163j applies primarily in these situations. Excess business interest expense must be reported on Schedule K-1 so that the taxpayer knows how much to carry forward until they have ETI or excess business interest income to offset it.

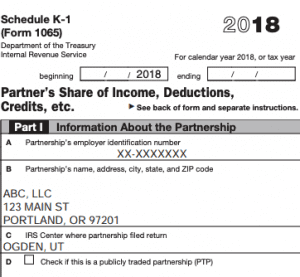

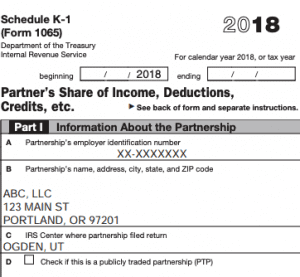

3 11 15 Return Of Partnership Income Internal Revenue Service

Excess business interest expense on Line 13K of partnership K-1 - WHERE DO I DEDUCT.

Schedule k-1 excess business interest expense. These codes are generated when the business you got the K-1 from was limited in their full deduction of Business Interest Income by the Section 163 j limitations in the new tax code. This return doesnt report the amount on schedule K. An amount on this line in 2018 triggers the filing of new Form 8990 Limitation on Business Interest Expense.

I have a 1065 with excess business interest expense. INSTRUCTIONS TELL ME ITS NOT PROVIDED IN PROGRAM AND THAT I. Schedule K-1 Form 1065 - Tax Exempt Income Non-Deductible Expenses.

The taxpayers business interest income for the year. However if Section 163j applies the amount of deductible business interest expense in a taxable year could be limited. 163 j rules which covered so - called earnings stripping and denied a corporations.

This information appears on Form 8990 Limitation on Business Interest Expense only if a partnership passed through excess business interest expense using Schedule K-1 code 13K or the Taxpayer is subject to 163 j limitation on business interest field on Screen 8990 is marked. Floor plan financing interest expense Sec. Most likely they made over 25 million in gross receipts but there are other criteria.

It is now for excess business interest expense an amount on this line in 2018 triggers the filing of new Form 8990 Limitation on Business Interest Expense. See the Instructions for Form 8990 for additional information. Any nondeductible business interest expense Excess Business Interest or EBI does not remain with the partnership and does not affect the entitys computation of deductible business interest in future years.

Excess business interest expense must be reported on Schedule K-1 so that the taxpayer knows how much to carry forward until they have ETI or excess business interest income to offset it. Limiting business interest expense. Line 13K - Excess business interest expense - Amounts reported in Box 13 Code K represent a taxpayers share of business interest that was limited under the provisions of the Tax Cuts and Jobs Act.

Amounts reported in Box 13 Code K may be required to be reported on Form 8990 - Limitation on Business Interest Expense Under Section 163j. Excess business interest passes through to the partner and reduces the partners basis in the partnership interest See instructions to 2020s Form 1065 K-1 instructions Codes K AE and AF. To indicate that the taxpayer is a small business taxpayer mark the Small business taxpayer field on Screen 8990 in the Schedule K folder.

Instead the EBI is allocated to each partner as an information item on Schedule K-1. Generally taxpayers can deduct interest expense paid or accrued in the taxable year. Line 20AF - Excess business interest - Amounts reported in Box 20 Code AF represent the business interest that was subject to a business interest limitation at the partnership level.

It reports it on schedule K and reports in box 13K of the K-1. Excess taxable income and excess business interest income or expenses are generally allocated to each partner in the same manner as non-separately stated income. In addition if a partnership has negative section 704d expense interest expense that is limited by basis negative section 704d expense becomes excess business interest expense in the year that the basis limitation no longer applies.

Prior year carryover excess business interest. If there is no excess business interest expense in the return passed-through from another partnership marking the field will stop Form 8990 from printing. On that 1065 there is no 13K input and I have to enter it into a passthrough 163j worksheet Pfx.

Per Schedule K-1 1065 Partners Instructions page 12. One of the owners is another PTE. If the partnership reports excess business interest expense to the partner the partner is required to file Form 8990.

Excess business interest expense must be reported on Schedule K-1 so that the taxpayer knows how much to carry forward until they have ETI or excess business interest income to offset it. Limitation on Business Interest Expense Under Section 163j. Excess business interest expense.

Instead a partner treats 50 of its allocable share of a partnerships excess business interest expense for 2019 as an interest deduction in the partners first tax. Excess business interest expense is only applicable to partnerships subject to section 163j. Any excess business interest expense not deductible under section 163j will be included in box 13 code K for inclusion in the basis limitation and is not reported here.

See Worksheet for Adjusting the Basis of a Partners Interest in the Partnership for additional information about. For tax years beginning after 2017 the deduction for business interest expense cannot exceed the sum of the taxpayers. When does Section 163j apply.

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Http Media Straffordpub Com Products Reporting Partnership K 1s On Form 1040 Tax Basis Capital Built In Gains And 2019 Additions 2020 02 11 Presentation Pdf

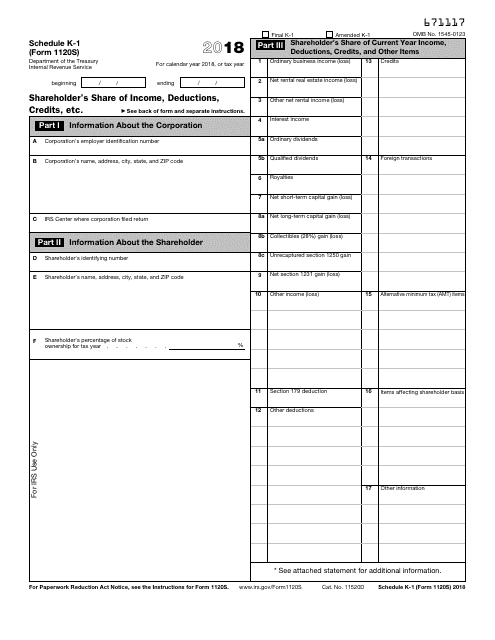

Https New Content Mortgageinsurance Genworth Com Documents Training Course Taxreturncasestudy Form1120s K1 2019 Pdf

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Federal Register Limitation On Deduction For Business Interest Expense Allocation Of Interest Expense By Passthrough Entities Dividends Paid By Regulated Investment Companies Application Of Limitation On Deduction For Business Interest Expense

Https Tax Iowa Gov Sites Default Files 2020 12 Ia163interestexpenseadjustment 2842039 29 Pdf

Instructions For Form 8995 2020 Internal Revenue Service

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Https Www Irs Gov Pub Irs Prior I8990 2019 Pdf

Irs Form 1065 Schedule K 1 Download Fillable Pdf Or Fill Online Partner S Share Of Income Deductions Credits Etc 2018 Templateroller

Federal Register Limitation On Deduction For Business Interest Expense Allocation Of Interest Expense By Passthrough Entities Dividends Paid By Regulated Investment Companies Application Of Limitation On Deduction For Business Interest Expense

Irs Form 1120s Schedule K 1 Download Fillable Pdf Or Fill Online Shareholder S Share Of Income Deductions Credits Etc 2018 Templateroller

Instructions For Form 8990 05 2020 Internal Revenue Service

Federal Register Limitation On Deduction For Business Interest Expense Allocation Of Interest Expense By Passthrough Entities Dividends Paid By Regulated Investment Companies Application Of Limitation On Deduction For Business Interest Expense

Https Www Irs Gov Pub Irs Utl 2017ntf Dealingpartnershipk1 Pdf

Https Www Irs Gov Pub Newsroom Lbi Tcja Participant Guide 163j 13301 Pdf

Posting Komentar untuk "Schedule K-1 Excess Business Interest Expense"