How To Do A K1 Form

K-1 Forms for business partnerships For businesses that operate as partnerships its the partners who are responsible for paying taxes on the business income not the business. Its not filed with your IRS Form 1040 but you generally must report any K1 income on a 1040 that you file.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

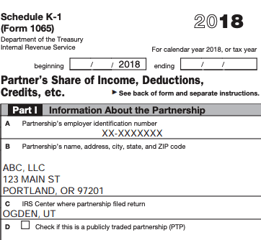

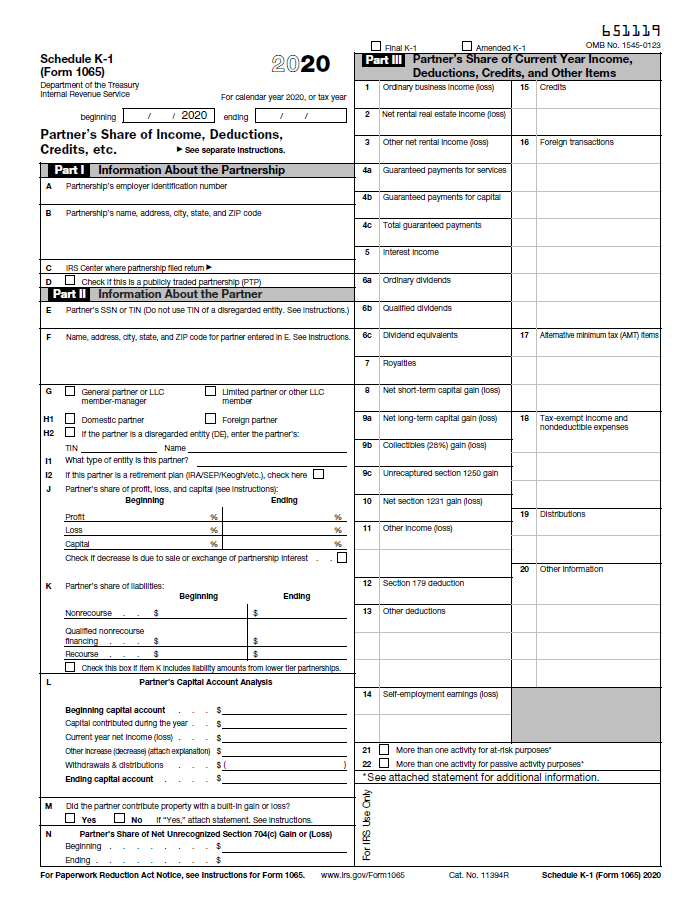

A Schedule K-1 form is used to report individual partner or shareholder share of income for a partnership or S corporation.

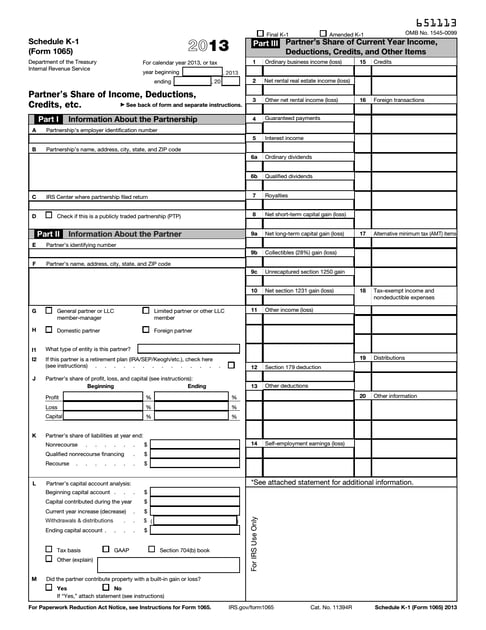

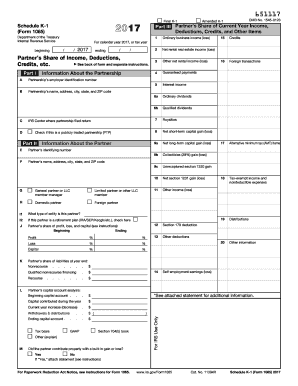

How to do a k1 form. There are eight items on the K-1 form that are entered directly on the 1040 form. A partnership business structure has at least two partners. Ive been working a very complicated file since my last post involving income in 11 states and countless K-1s Partners Share of Income Deductions Credits etc.

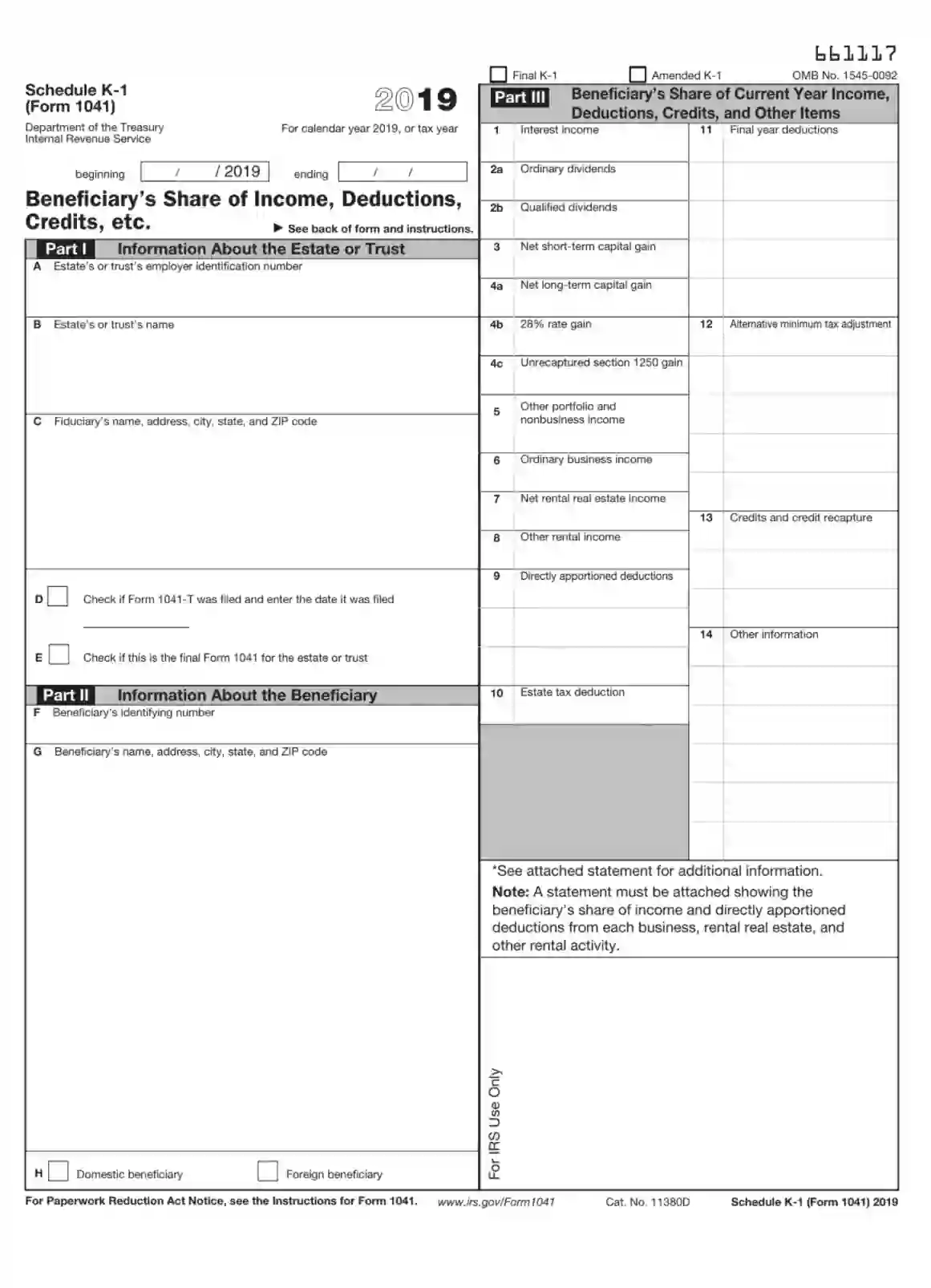

Generally you must file the source credit form along with Form 3800 General Business Credit to claim the general business credits listed on Schedule K-1 Form 1041 codes C through Q and code Z. A Schedule K1 tax form is necessary for the declaration of your share from an estatetrust partnership or corporation to the Internal Revenue Service. You generally dont have to file a copy of your K-1 tax form with your income tax return because the IRS already has the copy provided by the executor or the trustee.

The lesson learned is that you always start by requesting in writing that a corrected K1 be issued. However if your only source for the credits listed on Form 3800 Part III is from pass-through entities you may not be required to complete the source credit form. K1 K2 K8 and K9 Declarations forms to be complete transparent and accurate Declaration can be made by owner or Authorised Customs Broker S90 CA Electronic Declaration vide electronic Data Interchange for registration and agents to.

This post addresses how to use IRS Form 8082 to report an incorrectly issued K1. The purpose of the Schedule K-1 is to report each partners share of the partnership. With the tax season in full swing many of our accredited investors are in the process of submitting their tax documentation.

Each item reported on the K-1 must be entered on the 1040 form when completing year-end personal tax returns. You can elect to deduct 100 of these contributions on Schedule A Form 1040 line 11 or if you are not filing Schedule A on Form 1040 or 1040-SR line 10b subject to the 300 limit. Our mission is to protect the rights of individuals and businesses to get.

Filing Form K-1 With Tax Return. Schedule K-1 is an Internal Revenue Service IRS tax form issued annually for an investment in a partnership. S corporations partnerships and LLCs are considered pass-through business types because the businesss income passes through to.

Schedule K-1 is filed to tell you about earnings from a partnership or S corporation. Each partner is responsible for filing an individual tax return reporting their share of income losses tax deductions and tax credits that the business reported on the informational 1065 tax form. But an exception exists if Code B appears in box 13 of your Schedule K-1.

Each partner files a copy of this schedule with the Internal Revenue Service IRS. The Schedule K-1 also known as Form 1041 is used to report a beneficiarys share of current-year income credits deductions and other items. If you dont make this election add this amount to the cash contributions reported in box 12 using code A and enter the total amount subject to a 60 AGI limitation as discussed in the earlier code A instructions.

Get to know more about the K1 tax form. Yieldstreet has been distributing Schedule K1 forms and meanwhile fielding questions investors have about where the numbers reflected on those forms come fromThe goal of this article is to give you a breakdown of the numbers on your K1 and where you can find them in. DECLARATION FORMS Submitted in accordance with the method of entry eg.

A Schedule K-1 Form 1065 tax form reports on a partners share of the income deductions credits and more of their business.

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Irs Schedule K 1 Form 1041 Fill Out Printable Pdf Forms Online

3 Changes You May See On Your 2019 Partnership K 1s And Why They Matter Cohen Company

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

How Schedule K 1 Became Income Investors Worst Enemy The Motley Fool

How To Fill Out Schedule K 1 Form 1065 Example Completed Explained General Partner Llc Youtube

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

K1 Form Fill Out And Sign Printable Pdf Template Signnow

What Is A Schedule K 1 Form The Turbotax Blog

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

S Corp Tax Return Irs Form 1120s White Coat Investor

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Posting Komentar untuk "How To Do A K1 Form"